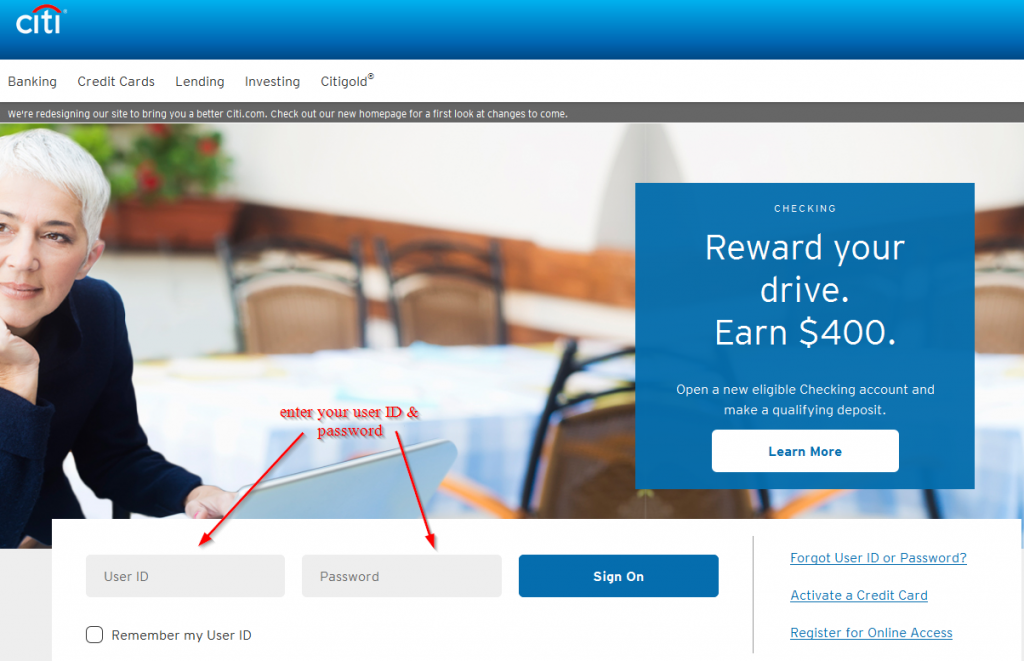

Although using the links are completely optional, we are eternally grateful when you do.ġTattedPassport is owned by 1TP Travel, Inc. For our complete advertising policy and details about our partners, please click HERE. Let’s get straight to the point…some of the links on this site pay 1TattedPassport a referral bonus for anyone that is approved. Don’t forget THIS GUIDE to remove Amex cards from your profile. What cards do you have in your wallet? Are you planning a wallet refresh? The chat button is much easier to use but if the bank removes the live chat at some point in the future (again), I trust the steps above will serve as a good foundation for completing the process. Generally, the live chat button is located in the lower right hand corner and says ‘live chat’, however, the bank removed this feature a few years ago but recently brought it back (I assume because of the current pandemic and challenges associated with responding to customers). It’s worth mentioning that Citi Bank currently has a ‘live chat’ function that you can also use to remove a card. If prefer (old) cards to not appear on your account, simply use the 3 steps mentioned above and you should have no problem removing them. …and voila! The card will be removed from your account upon confirming that you no longer want the card (or cards) to appear on your account. Simply, click the “unlink” button (located in the lower left hand corner) of the card that you would like to remove. STEP 3: MAKE IT OFFICIALįinally, on the next screen, the page will list all of the cards that are associated with your account. A drop-down menu should appear where you can then select “credit card services.” STEP 2: LINK/UNLINKĪfter selecting “credit card services” you will be taken to another screen where you will find and select the “Link/Unlink Citi Credit Cards” button on the left hand side of the screen. I like simplicity and wanted to remove the Citi AAdvantage Platinum Select card from my profile so here are the three steps that I took to remove the card… STEP 1: FIND SERVICESĪfter logging into your account, simply look for the “Services” tab at the top of your screen. However, now that I’ve PC’d the card, my profile homepage looks like this… 3 STEPS TO REMOVE CITI CARDS

In other words, I could meet the minimum spend, obtain the miles and “try it before I buy it.” The reason I applied for the Citi AAdvantage Platinum Select card was the annual fee was waived for the first year, and there was an increased welcome bonus so I gave it a shot. Similar to most co-branded airline cards, the earning rates are not as good as other cards for everyday purchases. To be completely candid, I did not plan to keep Citi AAdvantage Platinum Select card long term. To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review Bank of America Online Privacy Notice and our Online Privacy FAQs.As I said in my “refresh” post, I completed a product change (PC’d) from the Citi AAdvantage Platinum Select card to the Citi Double Cash card. These ads are based on your specific account relationships with us. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you log in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

CITI BANK ONLINE LOG IN OFFLINE

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. We strive to provide you with information about products and services you might find interesting and useful.

0 kommentar(er)

0 kommentar(er)